Credit card management made powerful.

Credit Card management solutions for the banking and NFBC industry covers modules such as card origination, card management and card collections.

Debit card issuance made simpler.

Transform your business with our end-to-end debit card management solution that helps businesses to instantly issue cards, set up controls, and manage the cards.

Simple, Safe, Secure Mutli Currency Prepaid card

We offer end-to-end prepaid solution that help customers to spend, control and earn rewards. Splendin prepaid card solutions support wide variety of prepaid - reloadable, disposable and more.

One Stop Loyalty Solution for all businesses.

Convert single visit customer as repeat customer with loyalty card solution. With Splendin end-to-end Loyalty solution boost your brand loyalty and improve customer engagement.

Faster Time-to-Market

Issue Instant Virtual Card

Card & Account Based Limits

Personalize Interest, Fees, Cashback and Rewards

Dynamic Spending Controls

PCI-DSS Compliant

Multi-Currency Support

Improved Customer Satisfaction

Strong Customer Engagement

Enhanced Brand Loyalty

Accelerate digital application processing with next-generation card origination solution.

Our end-to-end card origination digital solution to process credit applications within minutes across retail, business and corporate portfolio.

Single platform supports complete card origination capabilities.

Faster turnaround time to process the credit applications with right and suitable product offerings to customers.

Hyper personalized cross sell (up-sell or down-sell) offerings for better suitable products to customers

Integrate with Credit Bureaus, Fraud and various application sources in real-time

Full digital application processing solution

Define credit policy rules, under writing queues to review applications for additional information or exception processing

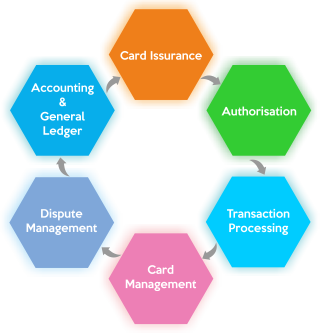

Digital API first platform offering end-to-end card life cycle management capability. Splendin Digital Card Management enables Banks, NBFCs to instantly issue Cards, transaction monitoring, fraud prevention, setup card controls, spend insights and seamless payment processing.

Splendin API first integrated solution seamlessly creates customer accounts, generate virtual cards within minutes.

Convenience & Control with robust rule setup to manage risk & reduce fraud. Provides multi-network, multi-currency, and real-time notifications.

Splendin card management system manages entire card account processing from interest calculations to statementing and card replacements to renewals

Improve transaction processing performance via online transactions, Interchange Batch File & multiple payments channels

Supports full lifecycle management of customer chargebacks.

Supports GL, MIS reports, and links to client-specific accounting booksSupports daily/monthly balances and business reconciliation reports.

Clients can choose interest rates, fees, and charges based on customer segmentation.

Supports Multi-Entity, Multi-Country, Multi-Currency, and Multi-Lingual operations.

Set up controls to manage accounts and cards based on status changes.

Supports PCI-DSS, Card Act, and strong encryption standards.

Define credit apportionment priorities for payment postings.

Leverage Open APIs for billing account management requests.

Set up programs for transaction or balance-based installment plans.

Define hyper-personalized offers or rewards to boost spending and satisfaction.

Reduce fraud rates and increase security via Dynamic CVV/PIN validations.

Support for digital wallets, QR code payments, NFC payments, and more.

Deliver real-time notifications to customers across transaction-related events to improve satisfaction.

Support for authorization batches to be processed for bill payments and more.

Automated clearing, settlement file processing, and exception handling via queues.

Support across various clearing house transactions such as Rupay, RBI, NACHA, MasterCard, and Visa.

Boost collection debt recovery using Splendin Card Collection.

Setup strategies for effective collection recoveries.

Predictive and reminder calling to boost the recovery rate.

Manage 3rd-party agency integration, collection performance tracking, and payments.

Locate skip customers using digital or credit bureau data.

Support for both litigation & reposession to aid collection recovery

Support for both soft collection and hard collection strategies.